Hybrid

Mutual Funds

Hybrid Mutual Funds, often referred to as balanced funds, are investment vehicles that combine elements of both equity and debt investments within a single portfolio. These funds are managed by professional fund managers who aim to strike a balance between growth and stability by investing in a mix of stocks and bonds.

- Hybrid funds offer investors diversification across asset classes. By investing in both equities and fixed-income securities, they aim to reduce overall portfolio risk.

- The equity component of hybrid funds provides the potential for capital appreciation over the long term.

- The debt component of hybrid funds helps mitigate the impact of market volatility.

4.4 ☆

Avg. app ratings

1 Cr+ downloads

45k Cr+

Investment

Managed

800 Cr+

Monthly MF

investment

All about Hybrid Mutual Funds

Hybrid Mutual Funds operate by investing in a mix of asset classes, typically combining both equity and debt instruments within a single portfolio. The allocation between equity and debt can vary depending on the fund’s investment objectives and the fund manager’s strategy. The equity portion provides growth potential, while the debt portion offers stability and income generation. Fund managers actively rebalance the portfolio to maintain the desired asset allocation and manage risk according to market conditions and the fund’s investment mandate.

Hybrid Funds earn returns through a combination of capital appreciation, dividends from equity holdings, and interest income from debt securities. The equity component of the fund aims to generate returns through price appreciation of the stocks held in the portfolio and dividends distributed by the underlying companies. The debt component generates income through periodic interest payments from bonds, treasury securities, and other fixed-income instruments held by the fund. Additionally, hybrid funds may also realize capital gains through trading activities and rebalancing of the portfolio.

Hybrid Mutual Funds are suitable for investors seeking a balanced approach to investing, combining the growth potential of equities with the stability of fixed-income securities. This makes them ideal for investors with moderate risk tolerance who desire both capital appreciation and income generation. Individuals who may benefit from investing in hybrid funds include:

- Investors looking for diversification across asset classes.

- Those seeking a balanced portfolio with reduced volatility compared to pure equity investments.

- Individuals with medium to long-term investment horizons who aim to achieve both growth and income objectives.

axation of Hybrid Mutual Funds varies based on factors such as the type of income earned and the holding period of the investment. Here are some key points regarding taxation:

- Capital Gains Tax: Capital gains from hybrid funds are taxed based on the holding period of the investment. Gains realized on units held for more than three years are considered long-term capital gains and taxed at a lower rate compared to short-term capital gains.

- Dividend Distribution Tax (DDT): Dividends distributed by hybrid funds are subject to Dividend Distribution Tax before being distributed to investors. However, tax treatment may vary based on the investor’s tax status and the prevailing tax laws.

- Indexation Benefit: In some jurisdictions, investors may avail of indexation benefits while calculating long-term capital gains tax. Indexation adjusts the purchase price of the investment for inflation, thereby reducing the taxable capital gains.

Investors should consult with tax advisors or financial experts to understand the tax implications of investing in hybrid funds based on their individual circumstances and local tax laws.

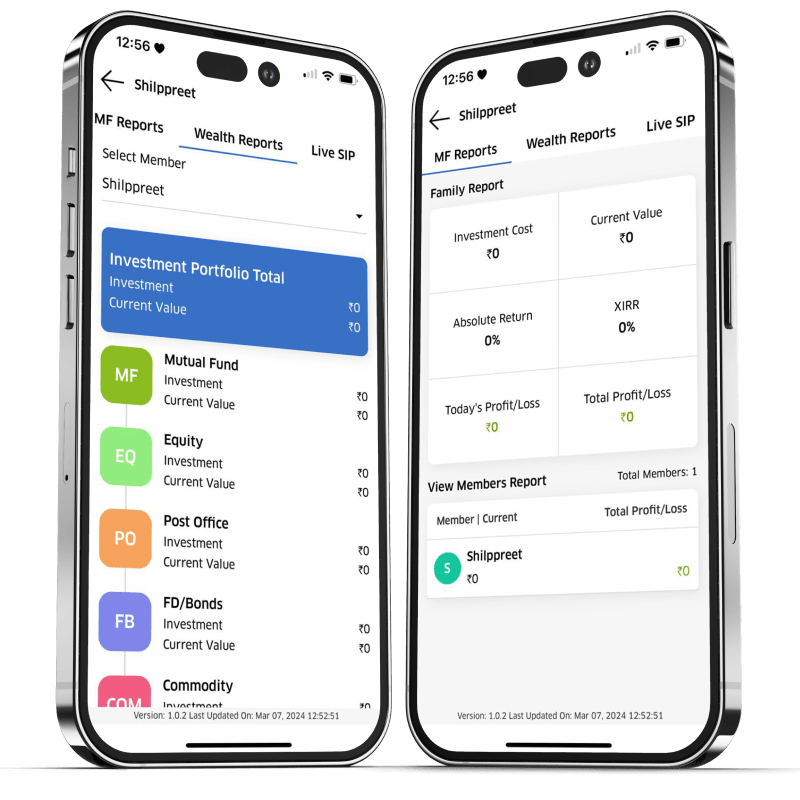

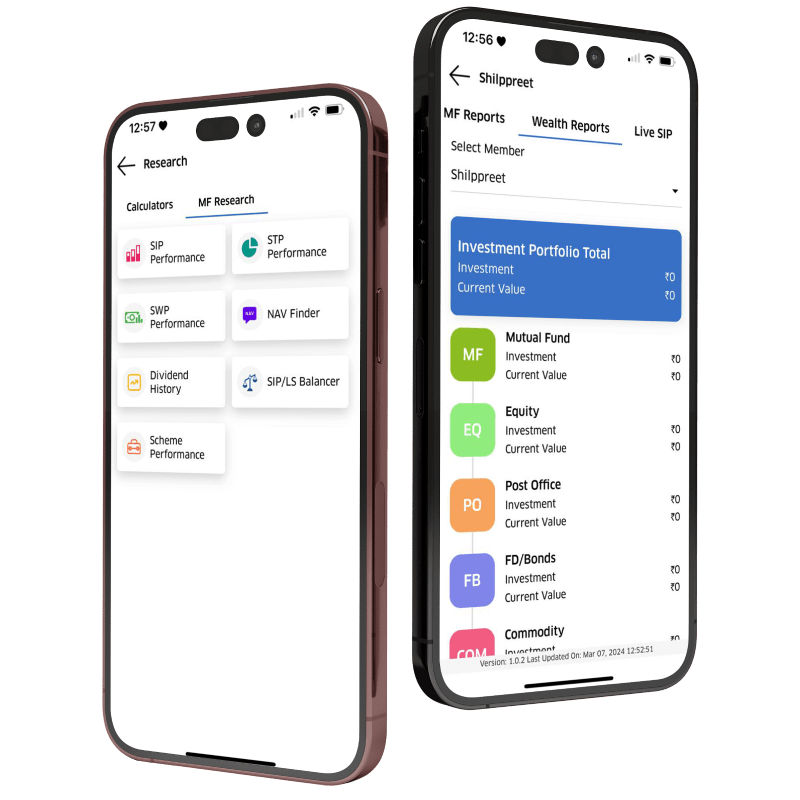

Sunglare Wealth Mutual Fund Benefits

Potential for Growth

Benefit from the growth potential of the Indian economy through our equity-oriented funds.

Risk Management

Diversify your portfolio and mitigate risks with our well-balanced fund offerings.

Tax Efficiency

Optimize your tax planning with our tax-saving mutual fund options, helping you save on taxes while building wealth.

Professional Guidance

Access expert advice and personalized recommendations from our experienced team of financial advisors.

Frequently Asked Questions

Hybrid Mutual Funds, also known as balanced funds, are investment vehicles that combine elements of both equity and debt securities within a single portfolio. These funds aim to provide investors with a balanced approach to investing by offering the growth potential of equities along with the stability and income generation of debt instruments.

- Diversification: Hybrid funds offer investors exposure to multiple asset classes, helping to reduce overall portfolio risk.

- Growth Potential: The equity component of hybrid funds provides the potential for capital appreciation over the long term.

- Stability: The debt component of hybrid funds helps mitigate the impact of market volatility and provides regular income through interest payments.

- Market Risk: Fluctuations in equity markets can impact the value of the fund’s equity holdings.

- Interest Rate Risk: Changes in interest rates can affect the performance of debt securities in the portfolio.

- Asset Allocation Risk: The fund’s performance may be affected if the allocation between equity and debt investments is not adjusted appropriately.

Returns in Hybrid Funds are generated through a combination of capital appreciation from equity investments and interest income from debt securities. Additionally, dividends from equity holdings contribute to the overall returns of the fund.

Hybrid Mutual Funds are suitable for investors seeking a balanced approach to investing with a moderate risk tolerance. They are often favored by individuals who desire both growth potential and income generation in their investment portfolios.

The minimum investment amount for Hybrid Funds varies depending on the fund house and the specific scheme. Many funds offer the flexibility to invest with relatively low initial amounts.

Taxation of Hybrid Mutual Funds depends on factors such as the holding period and the type of income earned. Capital gains from investments held for more than three years are typically treated as long-term capital gains and taxed at a lower rate. Dividends distributed by hybrid funds may be subject to Dividend Distribution Tax (DDT) before being paid out to investors. Indexation benefits may also be available to investors while calculating long-term capital gains tax.