Loan Against

Mutual Funds

Unlocking Financial Potential: Understanding Loan Against Mutual Funds

Loan Against Mutual Funds (LAMF) allows investors to leverage the value of their mutual fund investments to access funds for various financial needs. By pledging their mutual fund units as collateral, investors can secure loans at competitive interest rates, providing flexibility and liquidity without needing to liquidate their investments.

Sunglare Loan Against Mutual Funds Benefits

Competitive Interest Rates

Sunglare offers loan against mutual funds at competitive interest rates, allowing borrowers to access funds at favorable terms while leveraging their existing mutual fund investments.

Liquidity without Liquidation

With Sunglare's loan against mutual funds, investors can unlock the value of their mutual fund holdings without the need to sell or liquidate their investments.

Quick and Hassle-free Processing

Sunglare provides quick and hassle-free processing for loan against mutual funds, ensuring that borrowers can access funds promptly to address their financial needs.

Flexible Loan Options

Sunglare offers flexible loan options tailored to meet the diverse needs of investors.

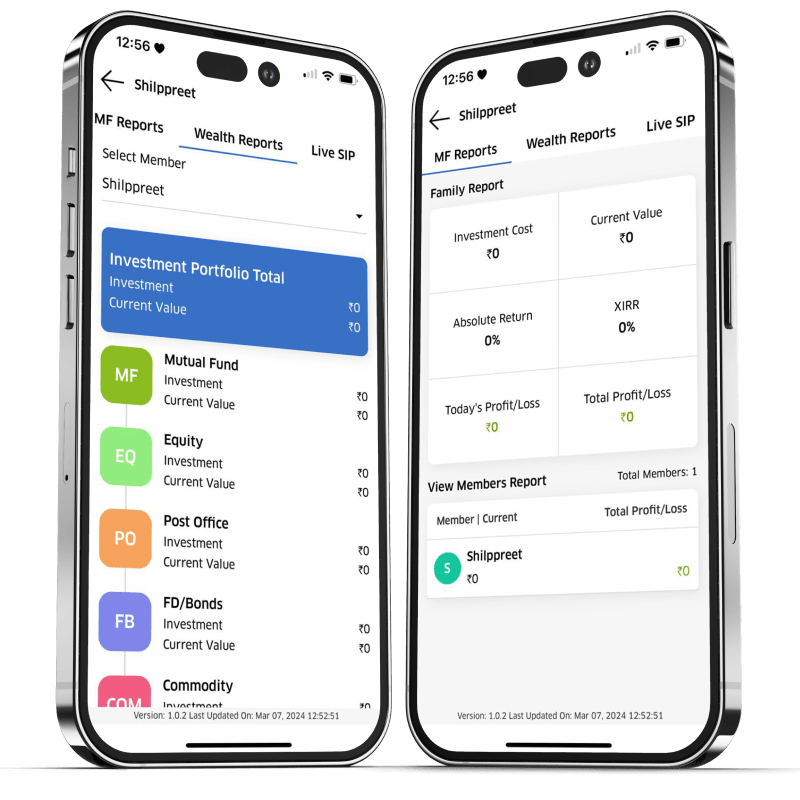

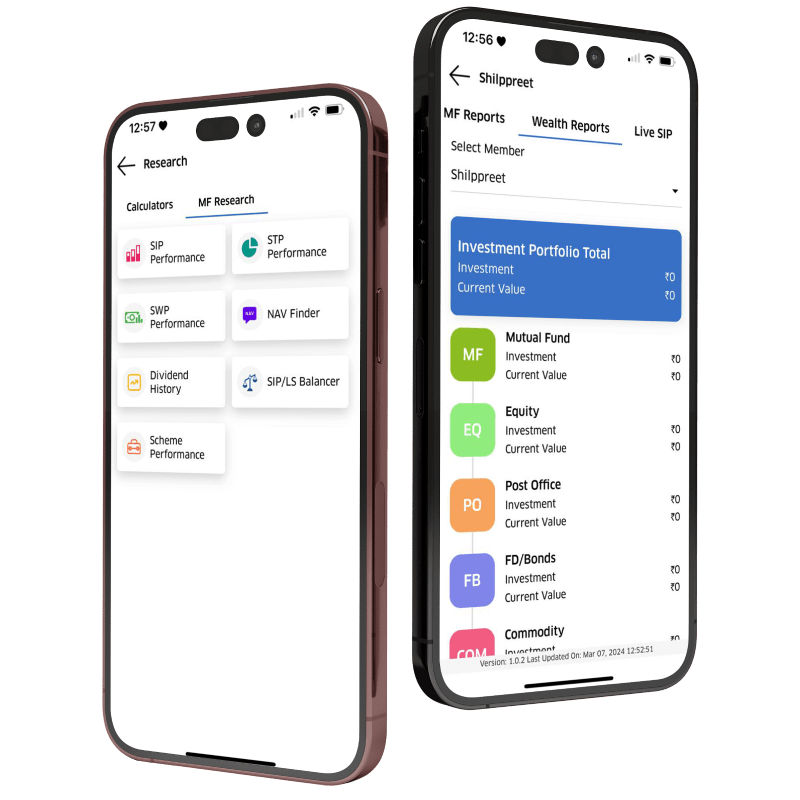

Why buy on Sunglare Wealth

Fast, easy & paperless

Benefit from the growth potential of the Indian economy through our equity-oriented funds.

Instant tax proof

Diversify your portfolio and mitigate risks with our well-balanced fund offerings.

Complete assistance

Optimize your tax planning with our tax-saving mutual fund options, helping you save on taxes while building wealth.

One click payment

Access expert advice and personalized recommendations from our experienced team of financial advisors.

5 Reasons to Choose Loan Against Mutual Funds

#1

Preserve Investment Positions

By opting for a loan against mutual funds, investors can maintain their investment positions intact, avoiding the need for premature liquidation and potential loss of future returns.

#2

Access to Immediate Liquidity

Loan against mutual funds offers immediate access to liquidity without waiting for the sale of securities, enabling borrowers to address urgent financial needs promptly.

#3

Capitalize on Favorable Interest Rates

Leveraging mutual fund assets for loans often comes with competitive interest rates compared to other forms of borrowing, potentially reducing overall financing costs.

#4

Maintain Diversification

Instead of selling off assets and disrupting portfolio diversification, utilizing a loan against mutual funds allows investors to retain diversified holdings while accessing needed funds.

#5

Flexibility in Usage

Whether for home renovations, education expenses, or unforeseen medical bills, loan against mutual funds provides flexibility in usage, catering to a wide range of financial requirements without restrictions.

Things to Know

Loan-to-Value Ratio (LTV)

Understand the maximum loan amount you can receive against your mutual fund investments, which is typically determined by the Loan-to-Value Ratio (LTV). LTV varies depending on the type of mutual funds and market conditions.

Impact on Investment Returns

Be aware of the potential impact on your investment returns when pledging mutual fund units for a loan. Loan against mutual funds may affect your ability to benefit from market appreciation and dividend payouts on the pledged units.

Risk of Margin Calls

In volatile market conditions, the value of your pledged mutual fund units may fluctuate, leading to potential margin calls from the lender. Understand the implications of margin calls and have a plan to address them if they occur.

Interest Rates and Charges

Familiarize yourself with the interest rates, processing fees, and other charges associated with loan against mutual funds. Compare rates offered by different lenders and evaluate the overall cost of borrowing before making a decision.

Loan Repayment Terms

Review the repayment terms, including the interest rate, tenure, and repayment schedule, before availing the loan. Ensure that you have a clear understanding of your repayment obligations to avoid any potential default or penalty charges.

Frequently Asked Questions

Eligibility criteria can include being an existing investor in mutual funds, holding mutual funds that are approved by the lender for such loans, and meeting the lender’s minimum loan amount criteria. The mutual fund units must be in dematerialized form, and the investor must have a clear record of ownership.

The time frame for processing and disbursing a Loan Against Mutual Funds can vary by lender but is generally quicker than traditional loans due to the nature of the collateral. After completing the application and providing necessary documentation, it can take anywhere from a few hours to a few days for loan approval and disbursement.

Failing to repay the loan can lead to the lender invoking the pledge, which means they have the right to sell the mutual fund units pledged as collateral to recover the outstanding loan amount. This can also negatively impact your credit score and future loan eligibility.

While your mutual funds are pledged as collateral for the loan, you cannot sell or redeem the pledged units until the loan is fully repaid. However, you can redeem units that are over and above the pledged amount, provided your mutual fund investment exceeds the collateral requirement.

The loan amount is typically a percentage of the value of the mutual fund units pledged as collateral, known as the Loan-to-Value (LTV) ratio. LTV ratios can vary depending on the lender’s policies and the type of mutual funds being pledged. Equity funds may have a different LTV compared to debt funds, reflecting the risk profile associated with each type of investment.

Not all mutual fund schemes may be eligible for loans. Lenders often have a list of approved mutual fund schemes that qualify for pledging based on their risk assessment and market performance. Typically, equity-oriented funds, debt funds, and hybrid funds are accepted, but specific fund acceptance criteria can vary between lenders. It’s important to check with the lender about which mutual funds are acceptable as collateral.

Taking a loan against your mutual fund units does not trigger any immediate tax implications because it does not constitute a sale or redemption of your mutual fund investments. Therefore, there’s no capital gains tax liability at the time of availing the loan. However, the interest paid on the loan is not tax-deductible against the income from investments. It’s advisable to consult with a tax advisor to understand any potential tax considerations related to your specific financial situation and investment portfolio.