Sunglare Wealth

Mutual Funds

Achieve long-term growth and financial security

Welcome to Sunglare Wealth Mutual Funds, your gateway to diversified investment opportunities tailored to your financial goals and risk appetite. Discover how our mutual funds can help you achieve long-term growth and financial security.

Sunglare Wealth Mutual Funds Benefits

Diversification

Mutual funds offer instant diversification by pooling investors' money into a variety of assets, reducing risk.

Professional Management

Benefit from the expertise of professional fund managers who make investment decisions on your behalf.

Accessibility

Mutual funds are accessible to investors of all levels, with options suited to various risk appetites and investment goals.

Transparency

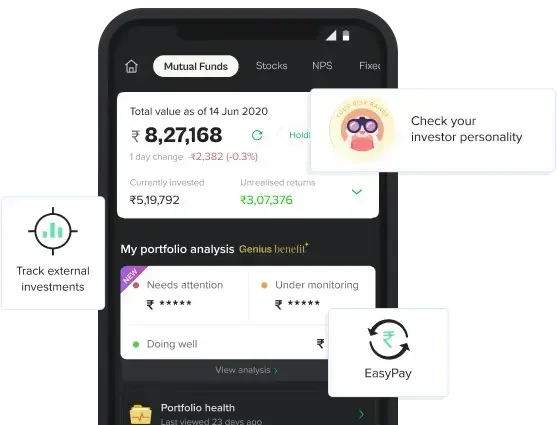

Access detailed information about fund performance, portfolio holdings, and fees to make informed investment decisions.

Types of Mutual Funds Based on Asset Class

Mutual funds in India are classified into different categories based on the asset class they invest in. Some popular categories are as follows.

Equity Mutual Funds

Equity funds invest a majority of their assets in stocks. These funds are classified into different categories based on the market cap of the stocks they invest in.

Types of Equity funds:

Large-cap funds

These funds invest at least 80% of their assets in the top 100 companies by market capitalization.

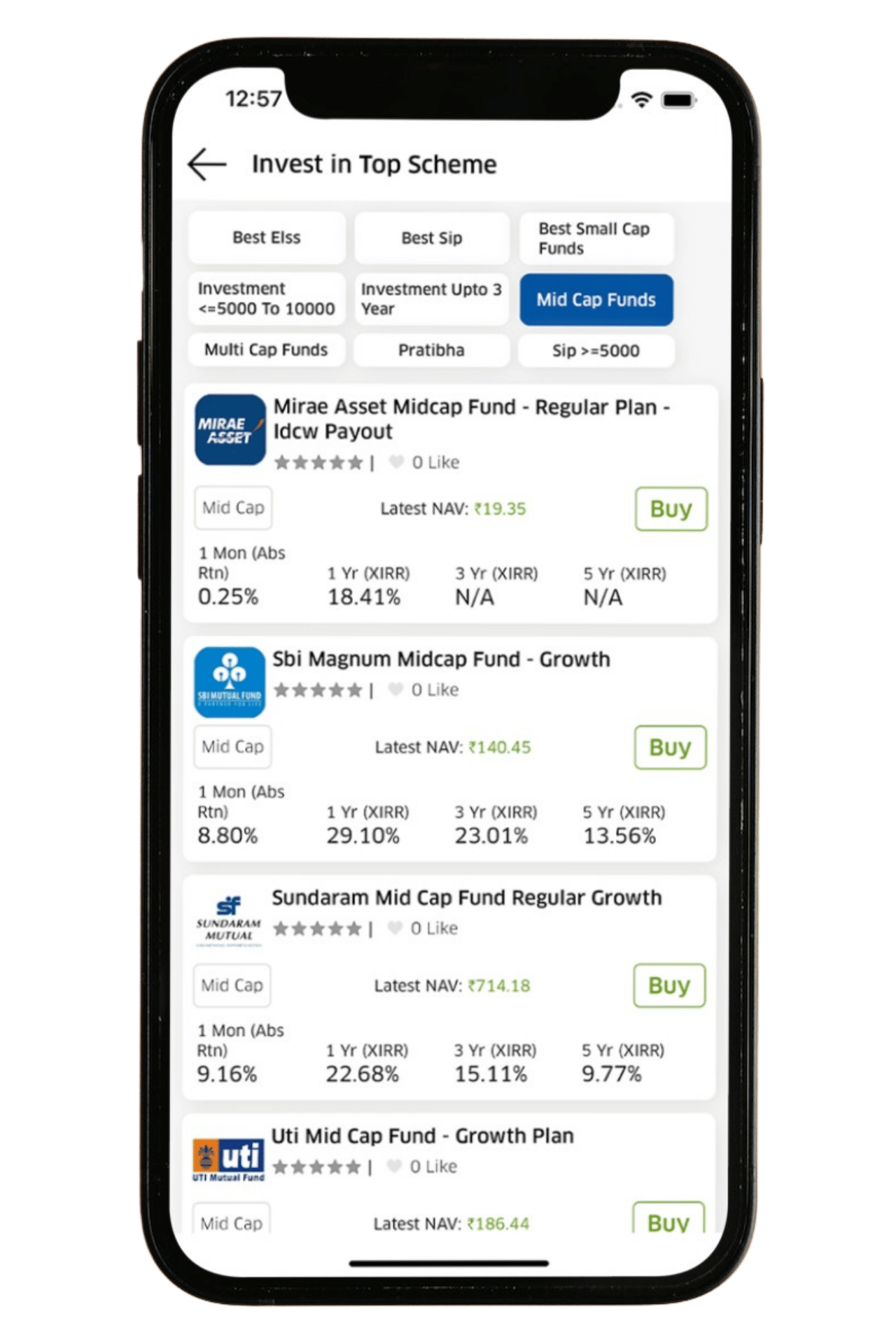

Mid-cap funds

These funds invest at least 65% of their assets in the next 150 (101st to 250th) companies.

Small-cap funds

Such funds invest at least 65% of their assets in companies ranked 251 and above by market capitalization.

Multi-cap funds

These funds invest at least 25% of their assets in each of the large, mid, and small-cap stocks.

Debt Mutual Funds

Debt funds generate returns by lending money to corporates and the government by buying their debt papers. These funds are classified into different categories based on their lending period and credit quality of the papers.

Types of Debt funds:

Money Market Funds

These funds generate returns by lending to companies or governments for up to 1 year.

Corporate Bond Funds

These funds earn returns by lending mostly (at least 80%) to companies with the highest-rated debt papers.

Overnight funds

These funds earn their returns by lending to companies or governments for one business day.

Liquid Funds

These funds generate their returns by lending to companies or governments for up to 91 days.

Hybrid Funds

Hybrid funds invest in a mix of asset classes, including equity, debt, or gold. There are multiple categories of hybrid funds based on how much they allocate across different asset classes.

Types of Hybrid funds:

Aggressive Hybrid

These funds have to invest at least 65% of their assets in equities while it can't exceed 80%. The rest goes into debt.

Multi-Asset Allocation

These are hybrid funds that invest at least 10% of the total of their assets across at least three asset classes, such as equity, debt, gold, etc.

Dynamic Asset Allocation funds

Also known as Balanced Advantage Funds, these funds can go up to 0-100% in equities or debt based on predefined asset allocation models they follow.

Arbitrage Funds

These funds generate returns by using opportunities of price differences of securities in different markets.

SIP Calculator

Potential for Growth

Benefit from the growth potential of the Indian economy through our equity-oriented funds.

Risk Management

Diversify your portfolio and mitigate risks with our well-balanced fund offerings.

Tax Efficiency

Optimize your tax planning with our tax-saving mutual fund options, helping you save on taxes while building wealth.

Professional Guidance

Access expert advice and personalized recommendations from our experienced team of financial advisors.

Frequently Asked Questions

- Diversification: Mutual funds offer exposure to a diversified portfolio of securities, reducing individual investment risk.

- Professional Management: Skilled fund managers handle investment decisions, saving investors time and effort.

- Liquidity: Most mutual funds allow investors to buy and sell shares on any business day at the fund’s net asset value (NAV).

- Affordability: Mutual funds have relatively low minimum investment requirements, making them accessible to a wide range of investors.

- Market Risk: Mutual fund returns are subject to market fluctuations, and investments can decline in value.

- Credit Risk: Bond funds are exposed to the risk of default by issuers of fixed-income securities.

- Interest Rate Risk: Bond funds are sensitive to changes in interest rates, which can affect bond prices and yields.

- Liquidity Risk: Some mutual funds may hold assets that are less liquid, making it challenging to sell them at desired prices.